And not enough cheap homes.

Read it here

Tag: economics

Egypt battles to rein in debt

Heba Saleh interviews Egyptian Finance Minister Amr Garhy

Read it here

The Rise of Transnational Kleptocracy – Power 3.0: Understanding Modern Authoritarian Influence

Read it here

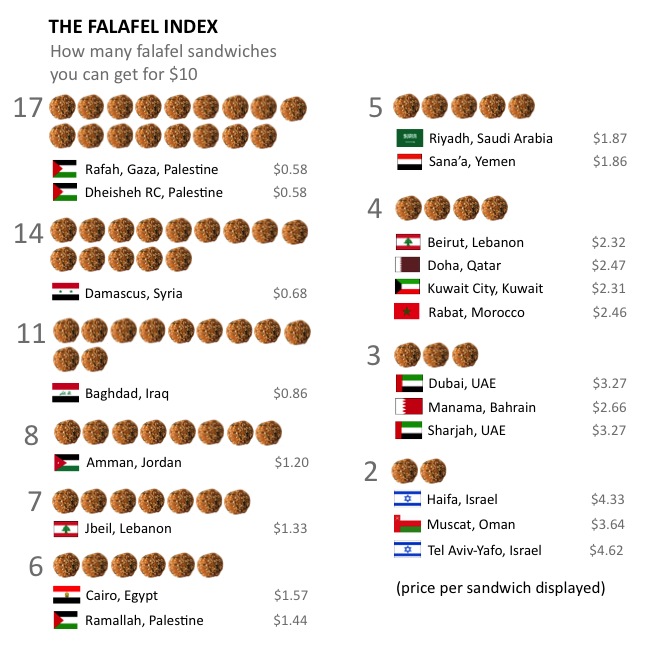

The Falafel Index

Neat exercise by Forbes – if Vox was Middle East focused, this is what it would do.

IMF: Midde Eastern economies are buffering global shock

“QUESTION: We talked almost about all the world’s economy. We did not talk about the Middle East. So what’s the outlook for the Middle East? And what do you expect them–what kind of role you’re expecting for them to play? And if you have time, also I would like to talk about the Lebanese example, because I think if not the only country, like one of the fewest country that was not–they were not affected by the financial crisis. So Mr. Blanchard or anyone.

Thank you.MR. DECRESSIN: Yes, we see growth in the Middle East slowing from around 6 percent in 2008 to 2.5 percent in 2009 and 3.5 percent in 2010. So, this is a much better scenario than the one that we have for the euro area or the U.S., for example.

So what’s happening in the Middle East? You have first the oil price decline which is affecting the economies; and, second, the general decline in global trade. And then for some countries in the Middle East, also the financial crisis. There are some instabilities in some banking systems.

Now, the governments have, in our view, reacted very forcefully. They had large fiscal surpluses during the oil price boom in 2008 and 2007 and so they’ve built up large asset positions. And what they are now doing is they are basically running large deficits to support the economies. And in that sense, they will soften the decline that is going to happen to non-oil activity, and we think that this is very important. Saudi Arabia, I think, among the G-20 is the country that gives the largest fiscal stimulus, and rightfully so.

At the same time, countries have also pulled all the stops with respect to monetary easing that they can pull, lowering reserve requirements, for example, and so forth. They have also injected liquidity in their banking systems. Countries have put money on the table for recapitalization. So on the whole, it’s a pretty strong policy response, and I think this validates our forecast of a decline in the growth rate, but still positive growth of around 2.5 percent this year.

Now, as to Lebanon, Lebanon has been a financial center, and our reading is at least that the country will be quite heavily affected. They’ve had growth of around 8.5 percent in 2008, and they’re going down to 3 percent. So they’ve been growing a little more than the average in the Middle East in 2008, and they are falling down to approximately the same level as theaverage in terms of growth rates. And there the financial sector is playing a big role as well because it’s a big part of the economy, and with generally lower activity everywhere in the Middle East, that will also reduce the financial flows from other Middle Eastern countries to Lebanon, and it will reduce the profitability of the banking sector.”

Since Lebanon is kept afloat by financial flows from elsewhere in the region and beyond, one should keep in mind how this will affect the political climate post-elections. When the pie shrinks, there’s more fighting for a slice…

Note that in chapter two of the IMF’s report on the global crisis, there is a section called “Middle Eastern Economies Are Buffering Global Shocks”. So basically Middle Eastern countries, esp. oil producers, are providing relief for the advanced economies of Europe and North America whose financial irresponsibility caused this crisis. And many of these countries, even when they have a lot of petrodollars, are poor. (Not to mention whatever kind of pressure is being put on major OPEC producers to keep oil prices low during the recession, beyond falling demand.)

Land of Ruins: A Special Report on Gaza’s Economy

Full transcript and more at Democracy Now.

Paul Krugman, where are you man?

[Thanks, Mandy]

Abu Dhabi’s investment in manufacturing

“But what makes Abu Dhabi unlike not just its sister and competitor emirates but pretty much everywhere in the Arab world is its peculiar devotion to manufacturing.

Much of its oil wealth is being used to start industries from scratch: in cars and aerospace, components and chips. As well as Daimler, it has invested in companies such as GE, Rolls-Royce, EADS and Advanced Micro Devices. This may look quixotic, yet invariably these stakes come with local training and manufacturing commitments.

Along with reform of local education, the goal is to use manufacturing to create skills and a culture of innovation – much more than to establish new branches of old industries. This at least tries to offer an alternative to the usual model in the Gulf – where the public sector employs the bulk of nationals – or the trading company model common in most other Arab countries.

Some 40 years ago, the Syrian philosopher Sadek al-Azm wrote a famous critique of the mind-set underlying serial Arab defeats. Arabs, he said, have become removed from the social and economic processes that make innovation and scientific breakthroughs possible. Abu Dhabi, it seems, wants to create, not just consume.”

If you have the cash and a taste for risk, this is a great time to mop up depressed stocks in companies that are fundamentally sound or have a great body of unique know-how. I’m still curious to see exactly how Abu Dhabi is convincing these companies to set up manufacturing centers in the emirates, and whether that makes sense (in trade logistics terms, it just might…)

Beinin in Wughett al-Nazar

Egyptian anti-smoking warning labels

The AP has a story out on the new labels, and the gory labels themselves are after the jump.

CAIRO, Egypt – Offering a cigarette is as common as a handshake in Egypt, where the culture of smoking is so entrenched that patients and friends sometimes light up in hospital rooms. But now, the government is finally getting serious about the health risks, launching a new campaign of stark visual warnings about tobacco’s dangers.

Starting Aug. 1, cigarette labels in Egypt will be required to carry images of the effects of smoking: a dying man in an oxygen mask, a coughing child, and a limp cigarette symbolizing impotence.

It’s a major step in Egypt’s fledgling anti-smoking campaign and a dramatic change in a country where public discussion of smoking’s health risks is nearly nonexistent.

. . .

For the new label requirements, authorities field-tested a variety of images.

They found that warnings linking tobacco with death were not particularly effective with Egyptians, since dying is perceived as inevitable anyway. Also, images of diseased lungs left people confused about what was being shown.

Instead, the new warnings focus on threats to health and, particularly, to family, like the effect on children and pregnant women and the risk of impotence. Numerous studies, including a 2003 report by Tulane University researchers, have found that smoking can be a major cause of erectile disfunction, in part because it constricts veins and arteries, reducing blood flow.

“We need something to give the smokers a shock that they are in great danger,” said Dr. Mohammed Mehrez, head of the tobacco control department.

There are many myths to overcome.

Some Egyptians are convinced only light cigarettes lead to impotence. Earlier this year, the state-owned manufacturer Eastern Tobacco Company voluntarily put pictures of diseased lungs on some packs — but smokers just figured those packs were the ones that were harmful and switched to others, which some shopowners promptly started selling at a higher price.

[From Egypt’s new tools in war on smoking: Stark warnings on impotence, disease]